Easy PPF Calculator

Maturity Amount: ₹0

Total Deposits: ₹0

Total Interest: ₹0

Saving money for the future doesn’t have to be complicated. If you’re thinking about investing in a Public Provident Fund (PPF), our PPF Calculator is here to help! It’s a free online tool that shows you how much your investment could grow over time, based on your yearly deposits and the current PPF interest rate of 7.1%. Whether you’re saving for a big goal like a home, your kid’s education, or just a rainy day, this calculator makes planning a breeze.

Ready to see your savings in action? Let’s break it down!

What is a PPF Calculator?

A PPF Calculator is a handy tool that figures out how much your Public Provident Fund investment will be worth when it matures. You just plug in how much you’ll save each year, how long you’ll invest, and the interest rate (right now, it’s 7.1%). Then, it does the math for you—showing you your estimated returns without any hassle.

It’s perfect for anyone who wants a clear picture of their financial future without digging through spreadsheets!

How Does the PPF Calculator Work?

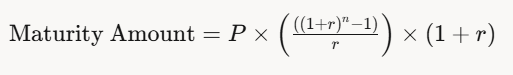

Wondering about the formula used for calculating PPF? Our calculator uses compound interest to estimate your maturity amount. It assumes you deposit money at the start of each financial year, and the interest compounds annually at 7.1%. Here’s the formula in simple terms:

- P: Your annual deposit

- R: The interest rate (7.1%)

- N: Number of years you invest

Don’t worry if that looks tricky—it’s just a way to show how your money grows over time. In reality, PPF interest is calculated on monthly balances, but this gives you a solid estimate for planning.

How to Use the PPF Calculator

Using our PPF calculator online is as easy as 1-2-3. Here’s a quick guide:

- Enter Your Yearly Deposit: Pick an amount between Rs. 500 and Rs. 1.5 lakh—that’s the PPF limit.

- Choose Your Investment Time: PPF starts at 15 years, but you can extend it in 5-year chunks.

- Check the Interest Rate: It’s set to 7.1%, though you can tweak it if you want.

- Hit ‘Calculate’: Boom! You’ll see your estimated maturity amount right away.

Imagine you save Rs. 20,000 a year for 15 years—our PPF maturity calculator will show you what that could turn into. Simple and fast!

Advantages of Using a PPF Calculator

Why bother with a PPF Calculator? Here’s why it’s worth your time:

- Plan Smart: See how your savings stack up for big goals.

- Save Effort: No need to crunch numbers by hand—it’s instant.

- Try Different Options: Play with deposit amounts or years to find your sweet spot.

- See the Growth: Understand how compound interest boosts your PPF returns.

- Always Free: Use our PPF investment calculator anytime at DivingFinance.com.

It’s like having a financial buddy to help you make better decisions!

FAQs About PPF Calculators

Got questions? Here are some answers to help you out:

1. What is a PPF Calculator?

It’s an online tool that estimates your Public Provident Fund earnings based on your annual deposits, investment period, and the current PPF interest rate of 7.1%.

2. What’s the current PPF interest rate?

As of March 2025, it’s 7.1% per year, compounded annually. But heads up—the government can tweak this rate every few months, so you can adjust it in the calculator if it changes.

3. Can I use the PPF Calculator for longer than 15 years?

Yep! PPF starts at 15 years, but you can extend it in 5-year blocks. Just set your preferred time in the calculator.

4. Does the calculator include withdrawals?

Nope, it assumes you keep investing without taking money out. PPF does allow withdrawals under certain rules, but this tool sticks to a basic growth estimate.

5. How accurate is the PPF maturity calculator?

It’s a close estimate based on your inputs. Actual amounts might shift a bit since PPF interest depends on monthly balances, but it’s great for planning.